Five things to know about Medicare:

- Medicare is a federal health insurance program.

- Medicare covers senior citizens age 65+ and people with disabilities.

- Medicare comes in 4 parts: Parts A, B, C, and D.

- Medicare Parts A & B are funded by the government.

- Medicare Parts C & D are provided by private companies.

Medicare is a federal program that ensures citizens who are disabled or 65 and older have affordable health care options. There are four parts of Medicare: Part A, Part B, Part C, and Part D. Each part covers different services.

Medicare terminology can get a little confusing. The different parts are often described in the following ways:

- Parts A: Hospital Insurance

- Part B: Medical Insurance

- Parts A & B combined are called Original Medicare

- Part C: Medicare Advantage

- Part D: Prescription Drug Coverage

As you may already know, Medicare typically covers a little more than 60% of total healthcare costs. A Medicare Supplement insurance plan, also known as Medigap, can help pay for deductibles, co-payments, co-insurance, and other out-of-pocket costs not covered by Original Medicare.

In order to get a Medigap policy, you must have Medicare Part A and Part B. Medicare Supplement plans work together with Medicare Parts A and B to reduce the healthcare costs you are responsible for paying.

Medicare can be confusing, we completely understand – That’s why we’re here to help you sort it out.

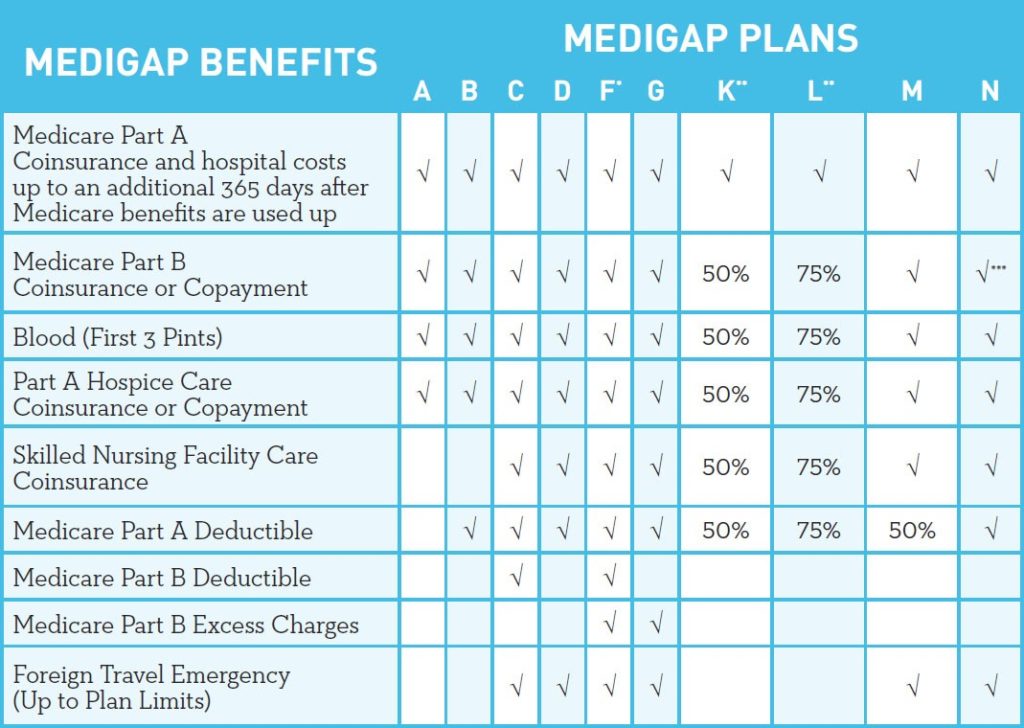

Choosing a plan that’s right for you is not always easy. Here is a chart outlining what services each supplemental policy covers that might help in your decision-making process. We know it is a bit overwhelming, so please feel free to Contact Us and we’ll walk you through everything – we’re here for you.

Medicare vs. Medicare Supplement Insurance: What’s the Difference?

PART A – Hospital Insurance

In general, Part A covers:

- Inpatient care in a hospital

- Skilled nursing facility care

- Inpatient care in a skilled nursing facility (not custodial or long-term care)

- Hospice care

- Home health care

PART B – Medical Insurance

In general, Part B covers:

- Medically Necessary Services – Services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice.

- Preventative Services – Health care to prevent illness (like the flu) or detect it at an early stage, when treatment is most likely to work best.

PART C – Medicare Advantage

Medicare Part C (also called Medicare Advantage) operates more like traditional health insurance than Original Medicare. If you choose to enroll in Medicare Part C, it will replace your Part A & B coverage. However, Medicare Advantage offers all the services that are included in Medicare Part A & B along with some additional benefits:

- All Medicare Part C plans have a $6,700 yearly out-of-pocket maximum

- Many Medicare Part C plans include prescription drug coverage

PART D – Drug Coverage

Medicare Part D is the Prescription Drug Coverage portion of Medicare. The plans are offered by private insurers and not the federal government. The prescription drugs that are covered and the costs of Part D plans will vary based on the plan you choose. This plan can help lower your prescription drug costs and help protect against higher costs in the future.

There are multiple Medigap Supplement Plans:

Medigap Plan A

Medicare Supplement insurance Plan A is not to be confused with Medicare Part A. Medicare Part A covers inpatient hospital care and is one half of Medicare (Part A and Part B). Medicare Supplement insurance Plan A refers instead to coverage that helps pay for out-of-pocket costs from Medicare Part A and Part B.

Medicare Supplement insurance Plan A covers 100% of four things:

- Medicare Part A coinsurance payments for inpatient hospital care up to an additional 365 days after Medicare benefits are used up

- Medicare Part B copayment or coinsurance expenses

- The first 3 pints of blood used in a medical procedure

- Part A hospice care coinsurance expense or copayment

Plan A is the most basic of the 10 Medicare Supplement insurance plans, covering the fewest benefits.

Medicare Supplement insurance Plan A policyholders are responsible for paying their Medicare Part A and Part B deductibles. They must also pay for skilled nursing facility care coinsurance, Part B excess charges, and foreign travel emergency costs. These five categories may be covered by other Medicare Supplement insurance plans. Plan A might be the ideal plan for those who don’t wish to pay costly premiums for benefits they might never use. However, Plan A coverage has the potential for higher out-of-pocket costs if the need for the uncovered categories arises.

Medigap Plan B

Once again, please note that Medigap Plan B is different from Original Medicare Part B, although their similar names may be confusing. Medigap Plan B includes the following coverage:

- Medicare Part B copayments and coinsurance

- The first three pints of blood you receive as a hospital inpatient or outpatient (Original Medicare usually covers any pints you receive after the first three)

- Medicare Part A deductible

- Medicare Part A hospital expenses and coinsurance up to 365 additional days after your Medicare benefits are depleted

- Hospice care coinsurance or copayment (Part A)

Medicare Supplement insurance plan B does not cover:

- Medicare Part B deductible

- Medicare Part B excess charges

- Skilled Nursing Facility care coinsurance

- Foreign travel emergency care

Medigap Plan C

Before we get into the specifics of what Medigap Plan C covers, it is important to point out that Medigap Plan C is not the same as Medicare Part C (also known as Medicare Advantage). With that out of the way, let’s get into specifics. Medicare Supplement Plan C covers:

- Medicare Part A hospital costs and co-insurance up to one year after Original Medicare (Part A or Part B) benefits are exhausted

- Medicare Part A hospice copayments and coinsurance

- Medicare Part B copayments and coinsurance

- the first three pints of blood for a medicinal procedure

- skilled nursing facility co-payments and co-insurance

- the Medicare Part A deductible

- the Medicare Part B deductible

- foreign travel emergency coverage up to 80% of the approved plan limit costs

Medicare Supplement Plan C (Medigap Plan C) does not cover Medicare Part B excess charges. Excess charges are doctor or specialist fees that may extend past the Medicare-approved amount for reimbursement or payment. If your doctor or specialist bills you for excess charges, the cost is your responsibility since Medicare will not cover them. Generally, doctors are allowed to bill a percentage over the Medicare-approved amount for some services, so be sure to ask your doctor for a thorough explanation of costs and your payment responsibilities before you schedule a visit or a procedure.

Medigap Plan F

Individuals can choose from many Medicare supplemental insurance plans to cover the gaps in Medicare coverage. While each plan covers a different number/combination of gaps, Medigap Plan F is the most comprehensive (it’s also the most popular). If you had not turned 65 by 01/01/2020, plan F is no longer available to you.

There are nine gaps in your Medicare coverage. Supplemental Plan F fills in those gaps. With a Plan F policy, you pay the monthly premiums for your supplement Medicare Part B and those for your prescription drug coverage (Medicare Part D). There are no additional charges for medical services. At first, you may need to make three monthly payments. Once you are receiving your Social Security benefits, the premiums will automatically be deducted before your check is deposited into your account.

Medicare supplemental insurance Plan F, like all supplement plans, is billed through Medicare. There are no out-of-pocket expenses. It will go to Medicare for the primary coverage before being billed directly to your Medicare Plan F carrier.

While Medicare Supplement Plan F is the most popular, individuals often select another plan. That is because the cost of Plan F can exceed the charges and premium you receive from another supplement plan or the individual can afford to have less coverage. The most popular options are Plan G and the High Deductible Plan F which are described below.

Medigap Plan G

There are many Medicare supplements, but only Plans C, G and F offer comprehensive coverage. While Plan F covers all the Medicare gaps, more and more individuals are choosing Supplement Plan G. That’s because even though it doesn’t cover Part B’s $198 deductible, Medigap Plan G typically has lower premiums that will offset any out-of-pocket expenses. (most popular plan)

Medigap Plan G is popular because, like Plan F, it sets a fixed amount for out-of-pocket expenses. The only gap in Medicare coverage not filled by Plan G is Part B’s $198 deductible. Once that’s paid, your only health services expense will be monthly insurance premiums. You won’t be surprised if you have to go to the hospital or doctor’s office. Your charges will always be processed through Medicare. Anything left over will automatically forward to your Medicare Supplemental Insurance.

Other gaps in Medicare covered by Plan G include:

- Medicare Part A Coinsurance

- Medicare Part A Deductible

- Medicare Part B Coinsurance

- Medicare Part B Excess Charges

- Hospice Care Coinsurance or Copayment

- Skilled Nursing Facility Care Coinsurance

- Charges for First Three Pints of Blood

- Foreign Travel Emergencies

Medigap High Deductible Plan G (HD-G)

The difference between the standard Medigap Plan G and the high deductible version is simple. You will have a $2,340 annual deductible in exchange for a lower monthly premium. That includes the Medicare Parts A and B deductibles along with any other coinsurance and copays covered by the standard plan. Who would benefit from this plan? Anyone with a substantial cash savings and good health can save considerable money on monthly premiums by going with High Deductible Plan G. This plan also lets members keep and use a Health Savings Account (HSA).

Medigap High Deductible Plan F (HD-F)

The difference between the standard Medigap Plan F and the high deductible version is simple. You will have a $2,340 annual deductible in exchange for a lower monthly premium. That includes the Medicare Parts A and B deductibles along with any other coinsurance and copays covered by the standard plan. Who would benefit from this plan? Anyone with a substantial cash savings and good health can save considerable money on monthly premiums by going with High Deductible Plan F. If you had not turned 65 by 01/01/2020 High Deductible Plan F is no longer available to you.

Medigap Plan K

Medicare Supplement Plan K lowers your potential costs with Original Medicare but it doesn’t cover all of the gaps completely. For some services, Plan K only pays 50% until you’ve met an out-of-pocket maximum limit. Plan K’s maximum limit is $5,880 in 2020. Once you’ve met the limit, Medigap Plan K will pay the rest of your approved costs for the remainder of the year. The limit resets at the beginning of each calendar year.

Plan K provides the following coverage:

- Medicare Part A coinsurance and hospital costs

- Medicare Part B coinsurance or copayment (50%)

- Blood – first 3 pints (50%)

- Part A hospice care coinsurance or copayment (50%)

- Skilled nursing facility care coinsurance (50%)

- Medicare Part A deductible, which is $1,408 in 2020 (50%)

Medicare Supplement Plan K doesn’t cover anything for the following services:

- Medicare Part B deductible, which is $198 in 2020

- Part B excess charges

- Foreign travel emergencies

If you don’t travel outside of the country, not having coverage for emergencies in other countries isn’t a risk for you. However, if you’re considering Plan K, you may want to confirm that none of your healthcare providers charge excess charges before you select this plan. Most providers don’t, but if they do, it can result in a fee to you of up to 15% of what Medicare would pay for the service.

Medigap Plan L

Medigap Plan L provides partial coverage for several Medicare benefit categories. This makes it an option for patients who need certain services but who are looking for a plan that doesn’t break the bank with high monthly premium prices. Plan L is not comprehensive. It is recommended to research other available Medigap plans as well to find which one best fits your needs. However, other plans will typically cost more than Plan L.

It’s crucial to understand that Plan L and other Medigap offerings are not intended to be used as your sole means of insurance. You will need to keep your original Medicare coverage (Part A or Part B) both for the benefits and because it is a requirement to enroll in Plan L. It is also worth noting that Medigap plans do not cover prescription drug benefits. They also do not interact well with Medicare Part C (generally called Medicare Advantage). This means that any co-payment or co-insurance costs you may incur as a result of your Medicare Advantage plan will not be covered or offset by Medigap Plan L. However, you are allowed to carry both simultaneously if you wish.

Plan L’s benefits typically pay 75% of the cost of its covered services. These services include:

- Medicare Part A deductible

- Medicare Part B co-insurance and co-payments

- Medicare Part A hospice coinsurance and copayments

- skilled nursing facility coinsurance

- the first three pints of blood for an approved medical procedure

Additionally, Medigap Plan L provides full coverage for Medicare Part A hospital fees and coinsurance for up to a year after original Medicare benefits are depleted.

Medigap Plan L also features a yearly out-of-pocket limit. This may result in significant savings if you have an unexpected medical emergency or you need ongoing medical care. Think of Plan L’s out-of-pocket limit as the maximum amount you will ever have to pay for medical services in a year’s time.

Medigap Plan N

Medicare Supplement Plan N has become one of the more popular choices. It has some unique features which make it more appealing than some of the other available Medicare supplement plans.

Medicare Plan N fills seven of the nine coverage gaps left by the Original Medicare insurance. The only gaps not covered are Medicare Part B’s $198 deductible and any excess charges that fall under Medicare Part B which are above the Medicare-approved amount. That means that any time you are admitted to the hospital, you and the 20% coinsurance for Medicare Part B will be completely covered.

What sets Medicare Supplement Plan N apart is that it requires copays for some services. A standard doctor’s visit has a $20 copay and an emergency room visit that doesn’t result in admission calls for a $50 copay. The Plan’s provisions were designed to prevent individuals from abusing the Medicare Part B system.

Additional Medigap Plan N coverage includes:

- Medicare Part A Deductible

- Medicare Part A Coinsurance

- Medicare Part B Coinsurance

- Hospice Care Coinsurance or Copayment

- Skilled Nursing Facility Care Coinsurance

- First Three Pints of Blood

Out-of-pocket expenses include:

- Medicare Part B’s $198 Deductible

- Medicare Part B Excess Charges

- $20 copayment for doctor visits and $50 for an emergency room visit that doesn’t result in admission.

The only way to know which plan is right for you is to discuss your expected health needs with your trusted insurance provider and let them help you compare pricing in order to determine which plan is the best fit.

At Bubba Collins Insurance, Inc., we strive to offer you the most affordable rates and we pride ourselves in giving you the utmost in customer service to help you find the best coverage for your individual needs. Contact us today to learn how we can help you!